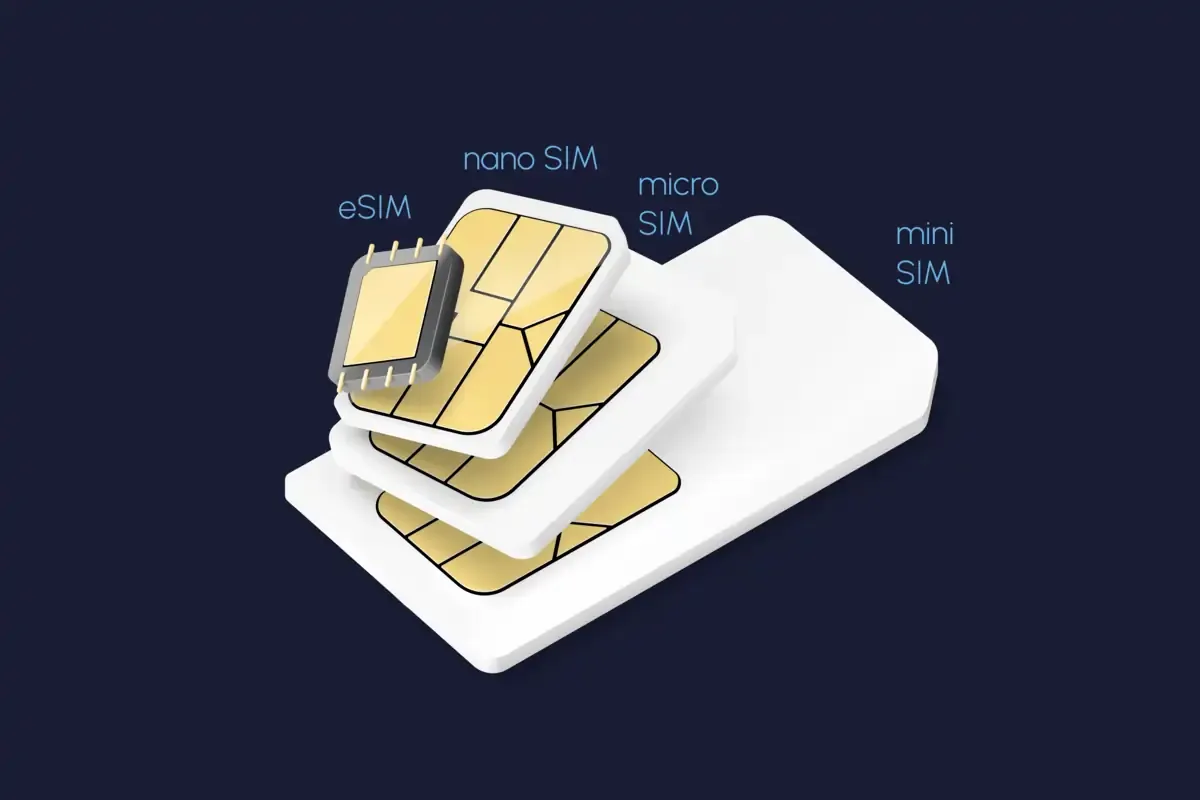

Despite its strong growth trajectory and clear technological advantages, the global adoption of eSIM technology is not without its challenges and restraints, which vary in significance across different market segments and regions. A critical analysis of the barriers within the Esim Market highlights that, on the consumer side, a lack of widespread awareness and understanding remains a significant hurdle in many parts of the world. While tech-savvy users and frequent travelers may be familiar with the benefits, a large portion of the mainstream consumer base is still accustomed to the decades-old process of using a physical SIM card. The process of activating an eSIM, while digital, can sometimes be perceived as more complex than simply inserting a plastic card, especially if it requires scanning a QR code or navigating through device settings. This requires a concerted educational effort from both mobile operators and device manufacturers to clearly communicate the benefits and simplify the activation process. Some mobile operators, particularly in less competitive markets, have also been slow to fully embrace and promote eSIMs, fearing that the ease of switching could lead to higher customer churn. This operator resistance, while diminishing, can still act as a brake on consumer adoption in certain regions.

In the enterprise and Internet of Things (IoT) sectors, the challenges are more technical and operational in nature. One of the primary hurdles is the initial complexity and cost associated with setting up the backend infrastructure for Remote SIM Provisioning (RSP). For a large enterprise wanting to manage its own fleet of IoT devices, deploying and integrating an RSP platform with its existing device management and billing systems can be a significant undertaking, requiring specialized expertise. While Blockchain-as-a-Service (BaaS) and managed connectivity platforms are emerging to simplify this, the initial integration effort can still be a deterrent for some companies. Another major challenge is managing the lifecycle of existing, legacy IoT devices that are already deployed in the field with traditional SIM cards. The cost and logistical difficulty of physically replacing millions of these devices with new, eSIM-enabled hardware can be prohibitive, meaning that for many years, companies will have to manage a hybrid environment of both physical SIMs and eSIMs, which adds operational complexity.

A third set of challenges relates to the fragmentation of the ecosystem and the nuances of global connectivity. While the GSMA has established a global standard, there are still different architectural models (consumer vs. M2M) and subtle variations in how different operators implement their eSIM solutions. Navigating the commercial agreements required to ensure true global connectivity for an IoT deployment can be a complex process, involving negotiations with multiple MNOs or working through a specialized global connectivity provider. The Esim Market size is projected to grow USD 29.59 Billion by 2035, exhibiting a CAGR of 31.4% during the forecast period 2025-2035. Furthermore, data sovereignty regulations in some countries may impose restrictions on where subscription management platforms can be located and how user data is handled, adding another layer of legal and compliance complexity for global deployments. Overcoming these challenges related to consumer education, technical integration, and global commercial complexity is key to unlocking the full, long-term potential of the eSIM market.

Top Trending Reports -

Cognitive Collaboration Industry